Sep 14, 2022

The HOMES Rebate Program: Efficiency for Everyone

Over the next 10 years, $4.3 billion will flow from the Department of Energy (DOE) to State Energy Offices across the country and into America’s homes through state HOMES Rebate Programs that aim to boost home performance, cut GHG emissions, drive demand for energy efficiency, and lower utility bills for Americans of all backgrounds.

By: Kara Saul-Rinaldi and Skip Wiltshire-Gordon

The Inflation Reduction Act of 2022 (IRA) invests historic levels of federal funding in American home performance. A centerpiece of the law’s efforts to transform residential energy efficiency is Section 50121, entitled Home Energy Performance-Based, Whole-House Rebates (HOMES). Over the next 10 years, $4.3 billion will flow from the Department of Energy (DOE) to State Energy Offices across the country and into America’s homes through state HOMES Rebate Programs that aim to boost home performance, cut GHG emissions, drive demand for energy efficiency, and lower utility bills for Americans of all backgrounds.

The HOMES Rebate Program has policy roots dating back to 2009, when its sponsor Rep. Peter Welch (D-VT) introduced the Retrofit for Energy and Environmental Performance Act that was included in the Waxman-Markey climate change bill. Although that package was not enacted, Rep. Welch and home performance advocates across the country continued to promote performance-based home energy retrofits in subsequent years, introducing the Home Star Energy Retrofit Act in 2010, the HOMES Act in 2019 and, in May 2021, the HOPE for HOMES Act, led by Rep. Welch in the House and Sen. Chris Van Hollen (D-MD) in the Senate. This summer, those years of advocacy paid off, as HOPE for HOMES is the basis of the HOMES Rebate Program and training grants that were a part of the Inflation Reduction Act—now law.

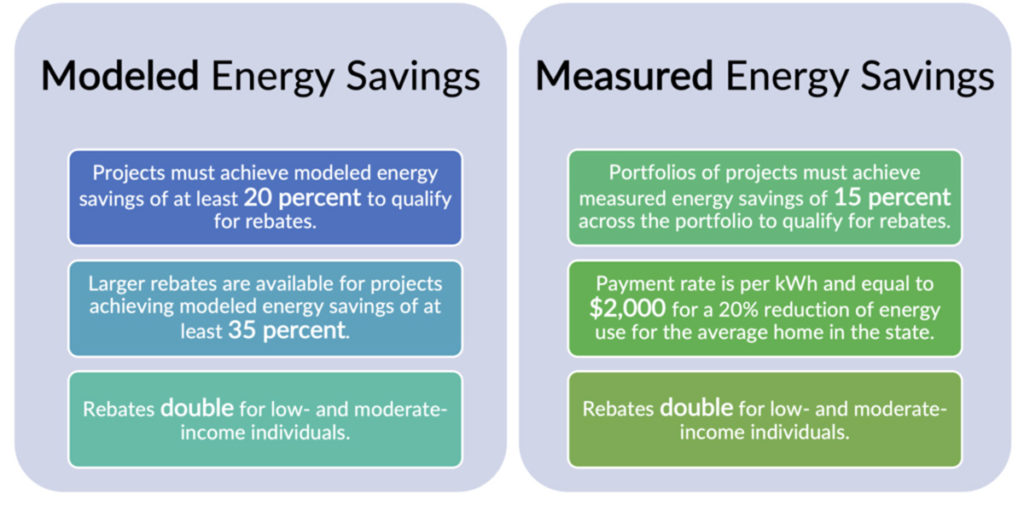

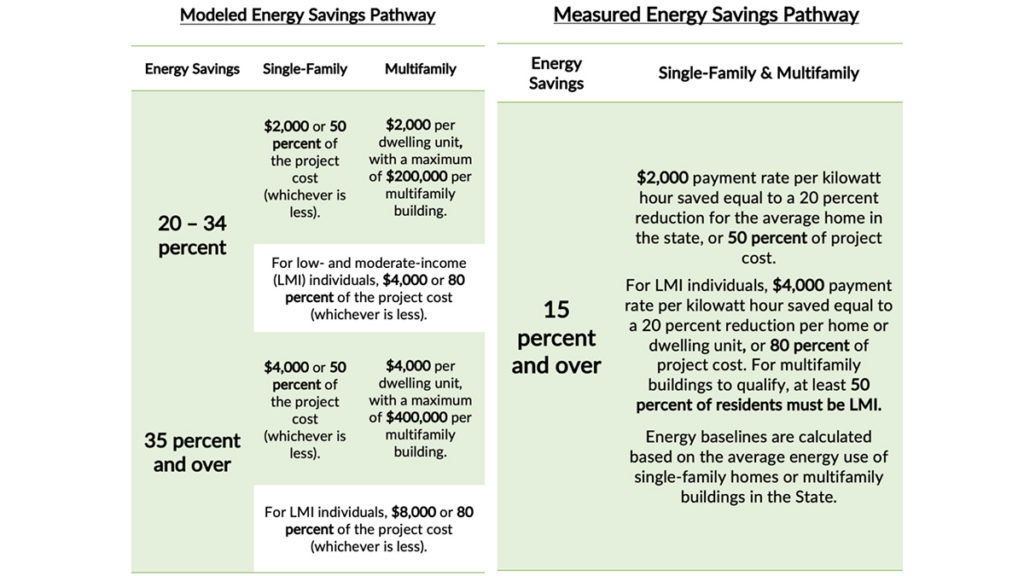

Funding from IRA will support individual state-run HOMES Rebate programs across the country to encourage performance-based residential energy efficiency retrofits. Rebates are doubled for low- and moderate-income households (individuals making less than 80 percent of area median income), so that Americans with the highest energy burdens can better-afford upgrades. In addition to robust rebates for LMI households, state HOMES programs can also reward those who work on energy efficiency in underserved communities. In fact, contractors operating under the program can claim a $200 rebate per underserved home they work on.

IRA prohibits combining HOMES rebates with any other Federal grant or rebate – including the new $4.5 billion High-Efficiency Electric Home Rebate Program. Still, IRA does not prohibit combining HOMES rebates with federal tax credits like 25C (Energy Efficient Home Improvement Credit), as well as state or utility rebate programs, which could allow “incentive stacking” to draw more households to pursue home performance upgrades. Funding will be distributed by DOE to states via a set formula, weighted by population and state energy consumption. If any states do not apply for and receive HOMES funding, unused funds will be redistributed to states operating HOMES rebate programs as early as 2024.

HOMES Tiered Incentive Pathways

Decarbonizing our nation’s 142 million homes—which made up 20% of U.S. carbon emissions in 2020—is essential to addressing the climate crisis. State HOMES programs will drive demand for residential energy efficiency through direct rebates, putting home performance contractors to work and slashing residential GHG emissions. Thanks to the IRA, states have new financial resources to support home performance—particularly for those who need it most.

This article was reposted with permission from AnnDyl.

For a full overview of residential home performance provisions contained in IRA, see AnnDyl’s previous post.