Aug 4, 2023

The IRA Rebate Question Everyone’s Asking

When will these rebates will be accessible to contractors and homeowners?

By: Macie Melendez

Yesterday, the Building Performance Association (BPA) held its third webinar in a series of Inflation Reduction Act (IRA)-related webinars. This one was very timely as it took place just one week after the U.S. Department of Energy (DOE) released guidance for state energy offices to apply for home energy rebate programs under the IRA.

These much-anticipated guidelines span a 100-page document and BPA’s Chief Policy Officer Kara Saul Rinaldi has been closely reading each page. The 90-minute webinar had lots of great information followed by a Q&A. Among the many questions asked is one that Saul Rinaldi says she’s been getting over and over again: What is a safe timeline to assume that these rebates will be accessible to contractors and homeowners?

The answer? “I don’t know,” said Saul Rinaldi. But then, she elaborated, saying that “it depends on where you are.”

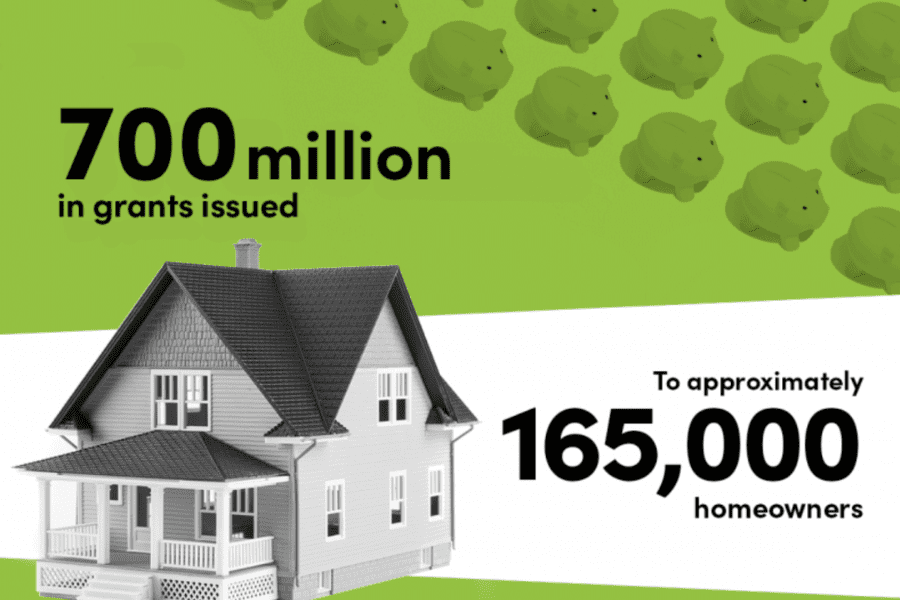

The IRA authorized DOE to carry out two Home Energy Rebate programs. Specifically, IRA Section 50121 established the Home Efficiency Rebates, and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates (collectively, the Home Energy Rebates). Together, the Home Energy Rebates authorize $8.8 billion in funds for the benefit of U.S. households and home upgrades, to be distributed to households by State Energy Offices and Indian Tribes.

These funds will be made available to the authorized recipients through formula grants. DOE is responsible for providing oversight and guidance, and each state is responsible for the administration of rebate programs for their state. In order to get this money, though, states need to apply and their programs need to meet these recently-released requirements. This is why “it depends on where you are.”

“Some states are moving fast,” said Saul Rinaldi. “They have plans ready to put forward. Now, they need to make sure their plans meet the guidance.” Some states are far along (New York and California, for example), some are working on plans (South Carolina, for example), and some have publicly announced they don’t plan on applying for these funds at all (Florida, for example).

One new thing that came out of this new guidance was something called a Quick Start program. As stated in the application requirements, “A State may apply for up to 25% of its allocated funds to develop a Quick Start State program. DOE will prioritize processing of applications identified for a Quick Start. To qualify as a Quick Start program, the State must note at the beginning of its application the request for a Quick Start, and the State must plan to achieve rebate program launch in 2023.”

One option for a Quick Start program is to develop a program that leverages an existing program infrastructure in the state. This would help a state see rebate funds much quicker. Also, according to the requirements, “States have the discretion to limit the scope to target specific populations, policy goals, or other State priorities to achieve more rapid rebate delivery.” The qualifiers there include that the state’s application needs to (1) identify the existing program(s) to be leveraged and (2) must include a timeline to achieve rebate program launch in 2023.

States could choose to use a portion of funding for a Quick Start program, and then launch a bigger program later on, too. As stated in the guidelines, “Prior to January 31, 2025, a State must either (a) request additional funding from its total formula allocation to continue its approved Quick Start program or (b) submit an application to DOE to administer a program operating under a different plan; otherwise, the remaining formula allocation will be considered rejected by the State and redistributed to other State Energy Offices.”

So, if you’re wondering if funds could be available to you in your state in 2023, the answer could certainly be yes. “I think 2023 is ambitious,” said Saul Rinaldi. “But the DOE thinks its possible or they wouldn’t have included the Quick Start program guidance.” Saul Rinaldi thinks that 2024 is more likely for these rebates, but states do have until January 31, 2025 to request funding, so it’s possible that a state would wait until 2025 to apply for funds.

States do have until September 30, 2031 to use their funding, so even if they do apply in 2025, there is still plenty of time to get rebates to homeowners.