Jul 15, 2024

Let’s Stop Worrying Over Load Growth and Get Serious About Solutions

As electricity demand grows, so too should the role of demand side solutions.

By: Sara Baldwin

In Fall 2023, Georgia Power filed an updated integrated resource plan with the Georgia Public Service Commission, warning dramatic near-term load growth predictions from data centers required “immediate action” to meet capacity needs by the end of 2025. Their proposed solution set was a combination of three new natural gas power plants (with a combined capacity of up to 1,400 megawatts (MW)), several fossil fuel power purchase agreements, and a modest 150 MW residential demand response program.

But in Spring 2024, tech giant Microsoft contested Georgia Power’s claims, citing concerns the utility was over-forecasting near-term load and procuring excessive, carbon-intensive generation. Microsoft has three data center campuses under construction in Georgia and is looking to expand to at least two more. The company also aims to have 100 percent of their electricity consumption matched by zero-carbon energy purchases 100 percent of the time by 2030—a clear mismatch with Georgia Power’s fossil-centric plans.

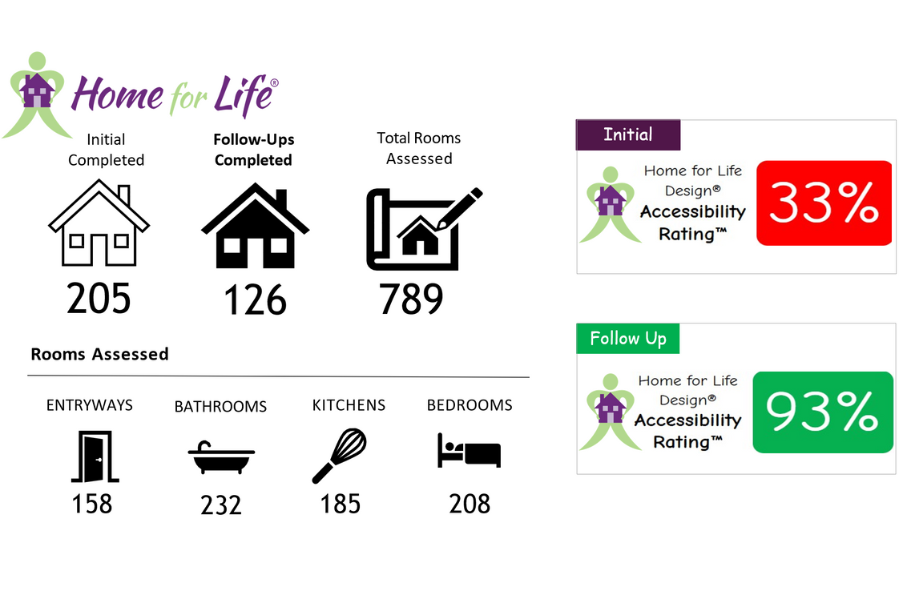

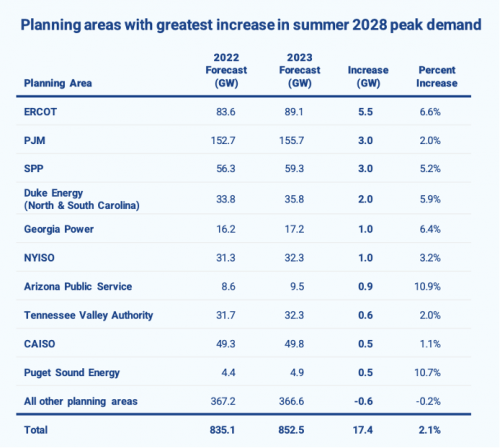

This tension is playing out across the country, as electricity demand is increasing in the United States after more than two decades of nearly flat load growth. Numerous utilities and grid operators are revising their 2023 load forecasts and predicting a doubling or more over the next decade, relative to 2022 predictions.

Electricity Grid Planning Areas with the Sharpest Increase in 2023 Load Forecast. Source: Wilson, John and Zach Zimmerman, The Era of Flat Power Demand is Over, Grid Strategies, LLC, December 2023.

Rapid growth is causing panic over potential capacity shortfalls and insufficient transmission, prompting calls to delay planned coal plant retirements and double down on new natural gas. But these fossil intensive supply side solutions are inherently slow and costly. They’re also incompatible with utility and customer climate commitments to hit net zero emissions by mid-century. Strategic supply side solutions are needed to meet growing demand, but these large investments will show up on electric customers’ bills for decades to come—they should reduce emissions in an affordable and reliable way.

Doubling down on demand side solutions is a cost-effective, least-regrets way to manage growth in the near-term, while unlocking their full potential over the long-term. They can respond to rapidly changing grid conditions and support grid reliability amidst the unpredictability of climate change. Although their decentralized and distributed nature makes them harder to plan for and manage, existing technologies and a growing ecosystem of providers are working to overcome these barriers.

If load growth is causing a crisis of confidence, utilities and grid operators should prioritize demand side solutions and work with customers to deliver valuable grid services. Similarly, policymakers and regulators should adopt policies encouraging demand side resources, increase visibility, enable data sharing, support innovative grid planning methods, and overcome misaligned incentives.

A rapidly shifting load landscape

A May 2024 Brattle Group report documents the rapidly changing landscape for utilities and grid operators, largely driven by new electricity demand from data centers, onshoring manufacturing, agricultural and industrial electrification, cryptocurrency mining, and electrification.

According to the report, in 2023 data centers alone represented 19 gigawatts (GW) of U.S. electricity peak demand, which is nearly double New York City’s 2022 peak load of 10 GW. New research from the Electric Power Research Institute forecasts data centers could consume up to 9 percent of U.S. electricity generation by 2030 – double the amount consumed today. Goldman Sachs estimates 47 GW of incremental power generation capacity will be required to support U.S. data center power demand through 2030, driving $50 billion in cumulative capital investment over the same time frame.

Not all demand sources are created equally. Some have longer lead times and steadier growth rates, like transportation electrification, making them easier to forecast and plan for. Others, like data centers or cryptocurrency mining, are large and can come online on a relatively short time span, requiring huge amounts of energy nearly instantaneously, challenging traditional grid planning and operation paradigms.

Some loads are more elastic and capable of quickly scaling back or shuttering operations in response to changing electricity prices, whereas others may be more inflexible. Electricity customers capable of reducing their impact during peak times could drastically reduce the need for new supply-side resources (thus bringing economic value to the grid and other customers). But, capitalizing on this demand flexibility potential requires adequate incentives.

In addition to the loads themselves, climate-driven extreme weather is disrupting tried-and-true approaches to managing the grid. “Everyone is clutching their pearls over data centers and crypto, but every time we have a polar vortex or a heat wave, similar load increases materialize to serve human needs like heating and cooling, but in a much shorter time span,” says electric reliability expert Alison Silverstein. “We cannot assume demand is immutable. With climate change-driven weather shifts, demand has become less predictable and at times terrifying.”

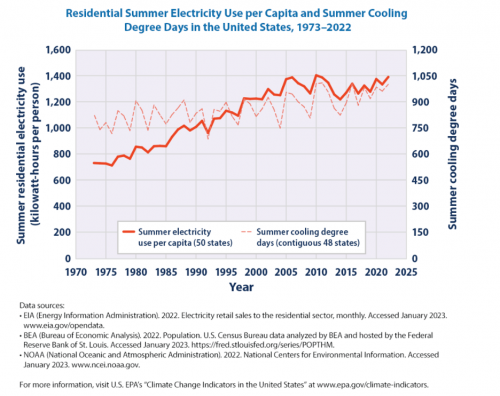

Residential Electricity Use per Capita and Summer Cooling Degree Days in the U.S., 1973- 2023.

Source: U.S. Environmental Protection Agency, Climate Change Indicators: Residential Energy Use.

In nearly every state, summer and winter peak loads are higher, longer and harder to forecast. Given the time and money required to build new generation and transmission to meet new demand, Silverstein argues “we can’t build our way out of this.” Now is the time to activate more energy efficiency and demand side solutions, which are cheaper and faster to deploy, and can also buy us time to make prudent supply side resource adjustments.”

A symphony of demand side solutions ready to perform

Like a combination of complementary musical instruments, demand side solutions encompass a wide range of technologies and applications that have the “potential to moderate the growth of both electricity consumption and peak load,” according to Brattle. For example, distributed generation (DG) like solar, wind, and energy storage systems can be paired with smart inverters or smart appliances capable of responding to changing grid conditions; demand side management (DSM), demand response (DR), and energy efficiency (EE) programs can help consumers reduce and modulate their electricity consumption in exchange for economic benefits; and managed electric vehicle (EV) charging programs can respond to economic or grid conditions to reduce the overall impact of EVs on the grid.

Communication and software tools, like distributed energy management system (DERMS), can make dispersed resources visible to utilities and grid operators so they can plan for and manage them in ways similar to larger supply side resources. Third-party aggregators and consumer-facing program administrators also play key roles as liaisons between grid operators, utilities, and consumers, helping streamline the process of recruiting customers, managing incentives, and pooling participating customers into aggregated resource blocks that can respond to grid needs when called upon.

Lawrence Berkeley National Laboratory notes recent improvements in broadband and local area communication and control systems are enabling faster coordination of demand response resources, such as commercial building HVAC or refrigerated warehouse end-uses, so that loads can be managed and dispatched as needed to support grid reliability.

DR programs deployed at scale can be highly effective at managing new load growth and serving existing load while contributing to grid reliability. These programs induce customers to reduce, increase, or shift their electricity consumption in response to economic or reliability signals. Most DR programs encourage utility customers to shift electricity consumption from hours of high demand (relative to energy supply) to hours where energy supply is plentiful (relative to demand). Future programs may signal customers to increase electricity usage when the grid has excess electricity generation from renewable resources like the wind or sun.

According to a 2019 Brattle Group study, nearly 200 GW of cost-effective load flexibility potential will exist in the U.S. by 2030, more than triple the existing demand response capability, and worth more than $15 billion annually in avoided system costs (i.e., avoided investment in new generation, reduced energy costs, deferred grid infrastructure, and the provision of ancillary services). This potential will only expand as more consumers adopt grid-responsive electric technologies and equipment.

Numerous utilities across the country and globe are relying on DR programs to tap into flexible loads on the grid, and they are increasingly valuable in the face of extreme weather conditions. For example, in Texas, following the devastating Winter Storm Uri 2021, municipally-owned utility CPS Energy launched a new winter program that enables the utility to modify consumers’ demand via their thermostats during periods of high energy use. Similarly, during a 2023 summer heat wave in Arizona, the state’s three largest utilities called on more than 100,000 customers, who get incentives for participating, to reduce their electricity use (by modifying their air conditioner temperatures using smart programmable thermostats) by a total of 276 megawatts (MW) during peak afternoon and evening hours. That amount of power is equivalent to just over half the capacity of an average-sized combined cycle natural gas plant. In the United Kingdom, electric utility Octopus Energy’s Flexible Demand trials paid around 100,000 households to shift their energy from peak times in lieu of paying a fossil fuel generator to switch on.

Depending on the program, participating customers can receive substantial economic benefits. For example, Westchester County, New York has received over $361,500 from NuEnergen, LLC for the county’s enrollment in three summer DR programs. Westchester remains on stand-by to reduce its energy usage during times when the grid is strained, and once alerted of an event, the county reduces energy usage at some of its facilities. To date, Westchester has earned over $1.5 million for participating.

Similarly successful programs target businesses and large energy users, often motivated to participate in programs that will reduce energy costs. For example, Ameren Missouri partners with Enel X to offer incentive payments for participating in a program designed “to maintain a reliable and cost-effective electric grid. Energy consumers can earn payments for committing to reduce their energy consumption temporarily in response to periods of peak demand on the grid.” In Michigan, DTE Energy offers interruptible rates to all its commercial and industrial customers, wherein electricity is discounted 10 percent to 25 percent for customers that agree to shed a minimum of 50 kilowatts and interrupt their electricity within one hour of notification. Failure to interrupt results in a penalty.

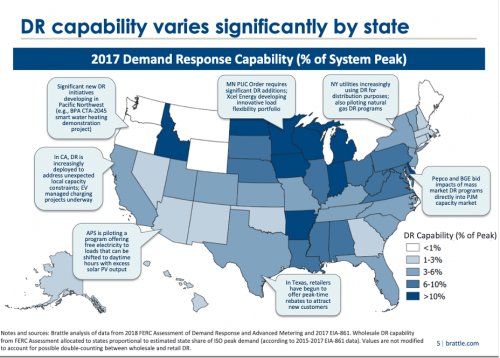

These are just a sample of the successful demand side programs across the country. Yet, today’s DR programs stack up to a mere 60 GW of capacity—about 7 percent of national peak-coincident demand—and residential and commercial customer programs make up only 30 percent of that. Some states have less than 1 percent of peak being met with demand side solutions, with only a handful exceeding 10 percent. Extreme heat and cold events can cause residential and commercial heating and cooling loads to make up nearly half of peak demand for some states (like Texas), prompting a closer look at what can be done to mitigate this in the face of increasing climate change chaos.

U.S. Map showing state-by-state percentages of Demand Response as a percentage of peak electricity demand. Source: Hledik, Ryan, A. Faruqui, T. Lee, and John Higham, The National Potential for Load Flexibility: Value and Market Potential Through 2030, The Brattle Group, June 2019.

Energy efficiency is another effective tool, particularly when efficiency programs are targeted to reduce customer energy usage particularly during peak hours. Efficiency measures such as replacing inefficient resistance heating and air conditioners with highly efficient heat pumps, adding attic insulation, duct sealing, and building envelope sealing can all help reduce customer electricity use on hot summer afternoons and frigid winter mornings, while improving comfort and energy savings. According to Silverstein, efficiency measures deliver benefits including better resource adequacy, lower wholesale prices, lower customer energy bills, lower grid infrastructure requirements, improve customer comfort and health, and lower carbon and pollution emissions.

ACEEE’s 2023 study, “Energy Efficiency And Demand-Response: Tools To Address Texas’ Reliability Challenges”, shows that using 10 aggressive peak-targeted energy efficiency and demand response tools in Texas could reduce both summer and winter peak demand levels by 15 GW or more, at costs far below the cost of building comparable amounts of new gas generators. Similar results are achievable in other states.

Shifting from solely supply-centric to increasingly demand-centered

Although demand side solutions have a proven track record of success, we’ve only scratched the surface. The electricity grid is still largely designed and operated to ramp supply side resources to meet shifting demand, not the other way around. And demand side solutions face challenges in their ability to scale, which prevents them from providing grid services. But times are changing, fast.

In the face of rapid growth combined with extreme and unpredictable weather, now is the time to shift away from solely supply-centric approaches to ones that activate demand side resources and flexible loads to their full potential. Looking forward, as the U.S. electric system uses increasing amounts of variable and weather-dependent resources (i.e., solar and wind) to serve demand, we must shift the system to manage demand resources to meet available supply, rather than managing supply resources to chase demand.

Many utilities and grid operators recognize the promise of demand side solutions, but most lack the tools or financial incentives to lean into them as significant, reputable resources to meet new load growth and ensure grid reliability and affordability.

For example, investor-owned utilities earn returns on large capital expenditures (i.e., new generation or grid infrastructure) and forgo shareholder profits when they rely on decentralized resources that avoid those investments. Bulk system planning and distribution planning are typically siloed processes, and few states or grid operators require coordination between the two. Wholesale market rules make it onerous for smaller aggregated demand side resources to participate in serving grid needs. Similarly, regional transmission operators lack visibility at a granular level on the distribution system, preventing them from forecasting and planning for demand side resources at scale. Scaled aggregation of multiple demand side resources into reliable grid resources that utilities and grid operators can see and count on consistently requires proactive regulation and oversight, as well as market maturity among the providers.

At the consumer level, program success hinges on people and businesses being willing and able to participate in programs, which may require adoption of new technologies, and a certain level of trust in their utilities (or retail electric providers) and aggregators. And not all customers contributing to the grid are compensated in proportion to the value they provide (which requires the adoption of forward-thinking policies, incentives, and rates).

Five approaches can overcome these challenges

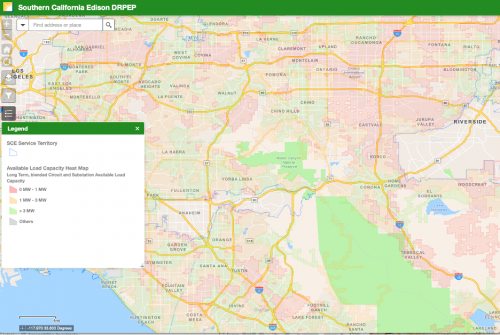

First, utilities and grid operators need clearer visibility of demand side resources. Fortunately, a myriad of options exists to help, including adopting DERMS or smart building management systems, utilizing more sophisticated models and control devices, allowing third-party aggregators, developing distribution system plans, and creating publicly available hosting capacity maps for customer-sited distributed generation and storage. A handful of states (CA, HI, MN, NV, and NY) require distribution system planning and mapping the distribution system at the circuit level, and the lessons from these states can inform others just starting down this path. States that require utilities to develop integrated resource plans (IRPs) should also require detailed distribution system plans, and those two efforts should be closely coordinated. A combination of tools can improve transparency about the state of the grid, including which technologies are being adopted and what programs might be suitable for managing load. Ideally, these tools could be combined to inform load forecasts and the development of demand-centered programs that can deliver guaranteed peak savings, alongside other reliability and benefits.

Screenshot of Southern California Edison’s interactive web portal showing granular distribution grid data within the utility’s service territory, including available load capacity heat maps.

Second, enable data sharing across the transmission and distribution systems. In a 2017 report, the North American Electric Reliability Council (NERC) issued a set of data-sharing recommendations to support better integration of distributed energy resources into bulk power system planning and operations. This included a detailed list of data important to support adequate modeling and assessment of bulk power system issues (such as substation-level data with aggregated DER data, transformer ratings, relevant energy characteristics, power factor and/or reactive and real power control functionality, among others). Data underpins visibility, but both sides of the grid need to agree on which data are most important and relevant (and how that data can be shared securely). Shared models that can communicate with one another and utilize said data in the same way is also imperative. All data sharing must be done with an eye to privacy and security protections, which also requires agreements among all participating parties as to what gets shared, in what format, and who gets access.

Third, place energy customers at the center of program and rate design. According to Silverstein, activating the full potential of DR and DSM requires “respectful, negotiated limits with customers, who should be treated as partners and compensated fairly—their economic incentives should be commensurate with any perceived or actual sacrifice and with the value they deliver to the electric system.” Effective programs can also function as educational tools, empowering more electricity customers to play a more active role in supporting grid reliability. Whether through incentives or rates, rebates or discounts, programs should be designed with an eye to scaling participation and optimizing benefits for the grid and all participating customers, including residential and lower-income customers.

Fourth, adopt utility performance incentive mechanisms (PIMs) that put demand side resources on a level playing field with supply side resources. PIMs can help shift the profit-motive by aligning profits with performance on certain metrics, like successful DR or energy efficiency programs. In the era of load growth and climate change, PIMs should target measures that provide reliability and affordability benefits for all customers.

And fifth, consider new approaches aimed at attracting more flexible and grid-supportive loads. This should apply across the electricity system from the wholesale bulk grid down to the distribution system. Rate design and tariffs that encourage or require new load sources to respond to and react to grid conditions, economic signals, and reliability needs could obviate the need for more expensive alternatives down the line. For example, the Electric Reliability Council of Texas (ERCOT) is proposing the establishment of a Demand Response Monitor to assist market participants and grid operators in making judgements of near-future capacity needs. The Monitor will detect a response by selected load responses attributable to locational marginal prices, coincident peak, conservation alerts, and other ERCOT actions. Over time, ERCOT could use empirical data from the Monitor to predict demand response for other reliability applications.

Rather than automatically approving load interconnection requests, utilities could evaluate their approach to cost allocation for grid upgrades or negotiate tariffs that require customer responsiveness under certain conditions. For example, to mitigate the cost of connecting large new loads like data centers, some utilities are requesting upfront payments to cover infrastructure costs and to mitigate the burden of investments on other customers. Google and NV Energy just announced a first-of-its kind clean transition tariff (pending regulatory approval) that enables Google and other energy users to meet growing power demand cleanly and reliably. Another Google pilot will reduce data center electricity consumption when there is high stress on the local power grid. Automakers and utilities are teaming up to expand managed EV charging programs to get ahead of load management before it becomes a problem at the local or system level. In an era in which multiple new loads are competing for the same space on the grid, utilities should consider rewarding those willing to go the extra mile in being a good grid citizen.

As electricity demand grows, so too should the role of demand side solutions. A renewed focus on the load side of the equation will ensure a more cost-effective and efficient grid built to respond to rapidly changing conditions, while also benefiting and protecting customers and mitigating carbon emissions.

This article was originally published on the Energy Innovation website and is republished with permission.