Jul 26, 2024

The Tax Credit Everyone Should Be Talking About

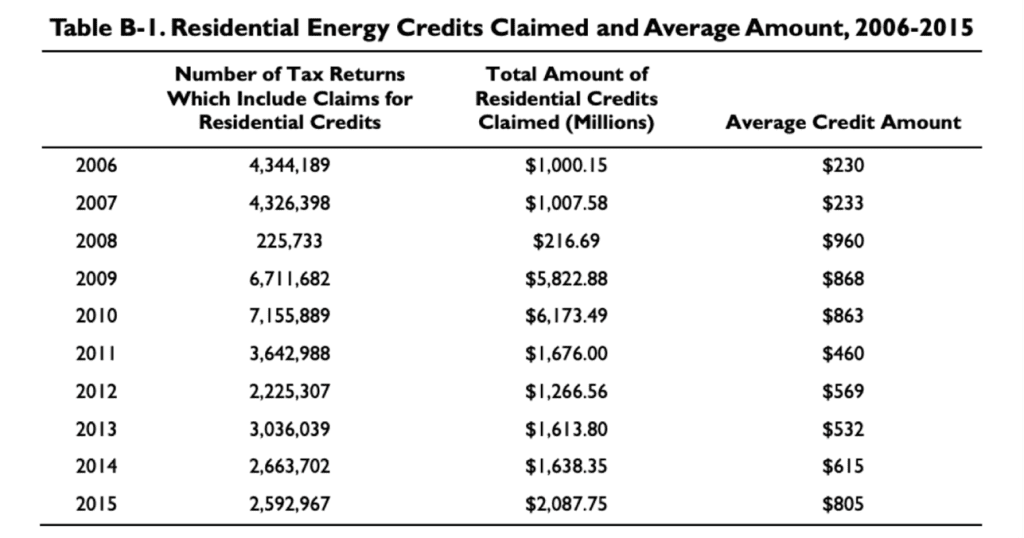

The 25C has been around for quite a few years, and millions of taxpayers have claimed this credit since 2006. It has proved to be a successful tool in a contractor’s arsenal to garner more leads and close more deals.

By: Xavier Walter

Why are energy efficiency practitioners waiting with bated breath for HOMES and HEAR rebates when they can immediately use the $3,200* yearly 25C tax credit to help drive business? While valuable, the reality is that the $8.8 billion in home energy rebates for income-eligible folks may not be available in most states until late 2024 or beyond. The 25C credit has been around for quite a few years, and millions of taxpayers have claimed it since 2006 – in fact, over two million households claimed the credit in 2023 alone. It has proved to be a successful tool in a contractor’s arsenal to garner more leads and close more deals.

What Is The 25C Tax Credit?

The 25C tax credit is a credit on a homeowner’s taxes—not just a deduction—for up to 30% of eligible measures not to exceed certain limits per measure. The total 25C credit that anyone can claim each year is limited to $3,200 with a mixture of various measures like insulation, heat pumps, or eligible electrical work. This is a dramatic increase from the credit’s previous lifetime limit of $500 and was signed into law under the Inflation Reduction Act (IRA) alongside many of the other great investments into energy efficiency and renewable energy.

This is for residential homes only, but not for landlords or commercial buildings. New home construction is also not included, but certifications like Energy Star and Zero Energy Ready homes may be covered under a different tax credit called the 45L for up to $5,000.

Why Aren’t Contractors Using It Today?

It appears that simple confusion on the ground could be an impediment to the uptake of this expanded tax benefit for consumers. Business owners are fearful to take risks associated with including something in their sale that can come back to bite them down the road (i.e., a consumer unable to take the credit due to unforeseen circumstances in eligibility, not having the right back up documentation, etc.). Many contractors have said they don’t feel comfortable educating their customers on the 25C simply because they don’t understand it or have heard the required documentation may be onerous or impossible to comply with.

Let’s break down some of these requirements so that we can figure out the commonly perceived barriers that may have prevented contractors from informing their clients of what is available. (See BPA’s 25C fact sheet for additional details.)

- Only materials costs qualify for insulation and air sealing, and not “onsite preparation, assembly, or original installation.” Contractors should make sure to specify the materials costs they are billing to the customer, separate from any labor costs, on the project invoice.

- The IRS does not specify or require specific methods for calculating materials and labor costs for 25C, so contractors retain some flexibility in how they invoice the different elements of the project. The IRS also allows a taxpayer to “make a reasonable allocation between the qualifying cost of the property and the nonqualifying labor cost of the installation.” Projects with over $4,000 in insulation materials costs billed to the homeowner will qualify for the maximum tax credit of $1,200 per year.

- Additionally, while labor costs are excluded from insulation, air sealing, windows, and other building envelope improvements, onsite labor and installation can be included in the eligible costs for heat pumps, furnaces and boilers, electrical panels, and water heaters.

- It is not difficult to determine which products are eligible, and paperwork requirements are minimal.

- If an item is not classified as load bearing, or a finished product, and it directly impacts the energy loss/gain of a building, it should be considered an eligible product if it meets the efficiency requirements (see below).

- The instructions clearly state that you don’t need to attach the documentation to your return, just to keep it in your file. Saving a copy of the window sticker, promotional materials, or other documentation will suffice.

- Work performed within a program with rebates and financing is typically still eligible for the tax credit.

- Any projects that utilize subsidized financing and where rebates are not treated as income for the customer must reduce the project cost by that amount. This includes any federal, state, or local programs designed to conserve or produce energy.

- If the homeowner receives a subsidy from a utility for the purchase or installation of an energy conservation product and that subsidy isn’t included in their gross income, they must reduce the cost for the product by the amount of that subsidy before calculating the credit. This rule also applies if a third party (such as a contractor) receives the subsidy on their behalf.

- Insulation and air sealing materials or systems that meet International Energy Conservation Code (IECC) standards in effect at the start of the year 2 years before installation.

- This one gets tricky because you will need to know what energy code cycle year was in effect two years prior and ensure that the work exceeds those levels for a credit. For the most part, most quality contractors like to meet or exceed minimums without having the customers incur costs above what is necessary.

- Windows and skylights must also meet the ENERGY STAR “most efficient” certification requirements, exterior doors must meet applicable ENERGY STAR requirements.

A Focus on Solutions

With all of these requirements identified, let’s focus on some solutions to make it easier for contractors to rest well at night knowing they have not deprived their customers from getting what is rightfully theirs, at the same time limiting liability from something outside of their control. The best way any businessperson can protect themselves in transactions like these is through a disclaimer. A small asterisk next to the number that says “*Please consult with your tax professional to ensure you qualify for this credit.” Of course, there are more reasons than those listed above for why a customer may not get this credit. The greatest of which is if they don’t have a tax appetite (the ability to fully use the entire tax credit in one year) or pay enough taxes to qualify.

One of the greatest opportunities, and threats, of the 25C is the $150 energy audit credit. This could certainly be used at the top and bottom of the sales funnel to create more leads and close more sales. What customer doesn’t want a $150 off something they may or may not already know they need? To qualify for this audit a few things need to happen, be documented, and accounted for in the process.

Starting during the 2024 taxable year, all energy audits must:

- Identify the most significant and cost-effective energy efficiency improvements for the home, including an estimate of the energy and cost savings for each improvement. This will most likely require some time of utility bill calibration and energy modeling to determine the savings. It is, however, an estimate and the auditor, at their discretion, gets to decide what that estimate may be.

- Be conducted, prepared, and signed by a certified home energy auditor. DOE provides a list of acceptable certifications of qualified Energy Auditors, this includes RESNET HERS Raters, BPI certified Building Analyst Professionals, and a few others.

- Be consistent with the most recent Department of Energy (DOE)-led and industry-validated Jobs Task Analysis.

One concern here could be that this incentive may impact the audit price up and down artificially. In some parts of the country, energy audits are offered for free to solicit leads for other energy efficiency services. In other places, audits can cost thousands of dollars depending on location, scarcity, or report type. There is a chance here that some professionals may use this audit as bait to go in and sell items outside of the priority list for their customers. It will be easy to offer a $600 credit on windows, plus $150 credit for the “energy audit” completed on the home.

While the IRS guidance does not provide much detail regarding health and safety issues being included in the energy audit, the guidance generally supports audits which address these topics. The instructions for form 5695 mention a “vapor retarder” as an eligible measure, and the certification requirements reference the DOE Job Task Analysis, which specifically includes health and safety as elements of the job task for energy auditors.

The Bottom Line

With the pending HOMES and Electrification rebates coming down to states through the Inflation Reduction Act (IRA), the 25C tax credit has taken a back seat and nobody is even talking about it. How this relatively small amount can stand up to $14k in rebates for a homeowner is hard to fathom. What we can say is that the 25C, based off past data, could wind up constituting a far larger federal investment than the $8.8.billion in Home Energy rebates.

The tax credit is also available for everyone, no matter what their income is, as long as they pay any federal taxes. It includes insulation and air sealing, heat pumps, as well as other measures that really lend towards the “whole home approach.” This tax credit can also help offset some of the costs of enabling upgrades to support 25C-eligible electrification products, and really be one more item on the estimate that helps drive the project cost down, and increase the opportunity to get the deal closed.

*The credit limit for each property is as follows:

- $1,200 for insulation or air sealing material system.

- $250 for one exterior door and $500 for all exterior doors.

- $600 for windows.

- $600 for central air conditioners.

- $600 for natural gas, propane, or oil water heaters.

- $600 for natural gas, propane, or oil furnace or hot water boilers.

- $600 for improvements or replacements of panelboards, subpanel boards, branch circuits, or feeders.

- $150 for home energy audits.

- $2,000 for heat pumps and heat pump water heaters; biomass stoves and biomass boilers.

For more information, visit www.irs.gov/pub/irs-pdf/i5695.pdf.

Note: BPA is not providing legal or accounting advice and all contractors and their customers should seek insights from a tax professional about their individual tax liability.