Aug 12, 2022

How the Inflation Reduction Act (IRA) Affects Our Industry

How does the Inflation Reduction Act affect you and your business? It will lower consumer energy costs, increase energy security, and reduce greenhouse gas emissions.

By: Macie Melendez

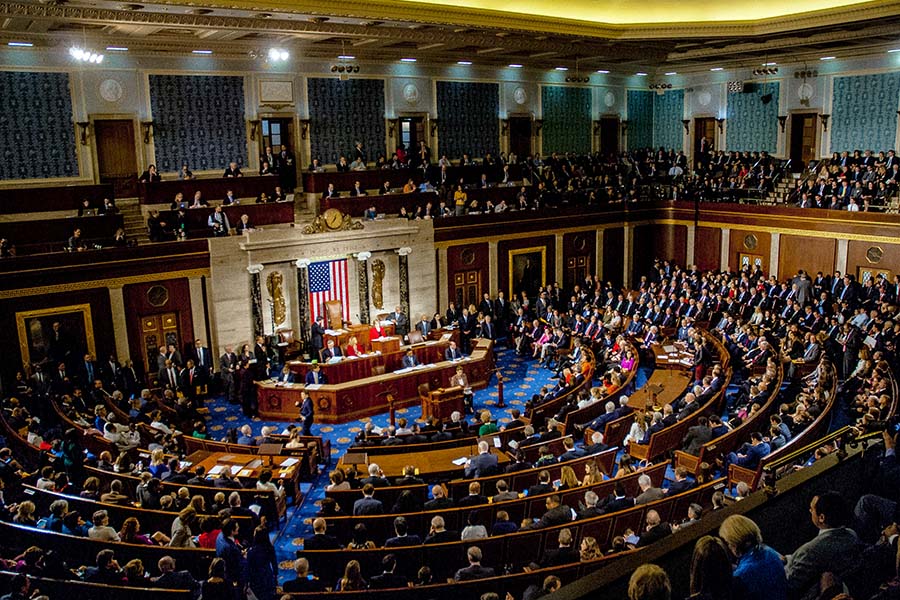

It’s official: the Inflation Reduction Act (IRA) has passed both the House of Representatives and the Senate. Next, the bill will end up on President Joe Biden’s desk to be signed into law.

The White House says the roughly $700 billion package will address inflation in two ways: by lowering energy and health care costs for families and by helping to bring down the deficit.

So, let’s answer the question you all have: How does this affect me and my business?

The historic investments included in the IRA will do three things related to energy: (1) lower consumer energy costs, (2) increase energy security, and (3) reduce greenhouse gas emissions. The part that matters most to the home and building performance industry is the first item: lowering consumer energy costs. Let’s break that down.

The IRA will provide a range of incentives to consumers to relieve the high costs of energy and decrease utility bills. This includes direct consumer incentives to buy energy efficient and electric appliances, clean vehicles, and rooftop-solar, and invest in home energy efficiency, with a significant portion of the funding going to lower-income households and disadvantaged communities.

Specifically, this includes:

- $9 billion in consumer home energy rebate programs, focused on low-income consumers, to electrify home appliances and for energy efficient retrofits. This $9 billion is broken in half, as follows:

- The HOMES Rebate program, which allocates $4.3 billion to state energy offices for consumer rebates for comprehensive home energy retrofits. This includes up to $4,000 for homeowners completing a whole-house project, based on the energy saving performance of the home—and the rebate amount doubles for moderate-income households (up to 80% of median income). The HOMES program also addresses multifamily buildings, with owners also eligible for up to similar per-unit incentives when they achieve certain energy savings levels.

- The High-Efficiency Electric Home Rebate Program, which will direct $4.5 billion to state energy offices for the efficient electrification of low- and moderate-income households (up to 150% of median income), including both single family and multifamily properties. This will include up to $1,750 for a heat pump water heater, up to $8,000 for a heat pump for space heating or cooling, up to $840 for electric cooking equipment or a heat pump clothes dryer, as well as funding for upgrading electric load service, insulation and air sealing, and electric wiring.

- An 11-year extension of the consumer tax credits to make homes energy efficient and run on clean energy, making heat pumps, rooftop solar, electric HVAC and water heaters more affordable.

- $4,000 consumer tax credit for lower/middle income individuals to buy used, clean vehicles, and up to $7,500 tax credit to buy new clean vehicles.

- $200 million to state energy offices for training and education to contractors involved in the installation of home energy efficiency and electrification improvements.

As an individual who works in the home and building performance industry, this means a couple of things. First, more customers. With these rebates and tax credits, more people will be able to make their homes more energy efficient. And with more demand comes the need for more supply. So, the second way this affects our industry is a need for skilled workers. The State-Based Home Energy Efficiency Contractor Training Grants included in IRA provide $200 million to train and educate contractors (aka you and your business!).

While this bill doesn’t necessarily focus on housing, the package includes a number of housing-related provisions that, when taken together, can help make homes and communities more energy efficient, affordable, and climate resilient.

“This historic legislation is exactly what the home and building performance industry needs,” said Steve Skodak, BPA CEO. “The report highlights the urgent need for more robust workforce development to train and equip workers with the skills to deliver effective home upgrades at scale. The Building Performance Association is poised to meet the upcoming demand to train the industry. We’ve been working locally and nationally to complete needs assessments that have allowed us to create training resources that fill the gaps needed to upskill our workforce. We’re ready for the demand—and we’re ready to help Americans lower their energy bills.”