Resource Library

Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers

Overview

Read about potential eligibility for tax credits for using eco-friendly technology at a home, building, or property.

Quick Links

Frequently Asked Questions

Q: Who is eligible for tax credits?

A: Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products.

Q: What do consumers do to get the credit(s)?

A: Fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Include any relevant product receipts.

Q: Are there limits to what consumers can claim?

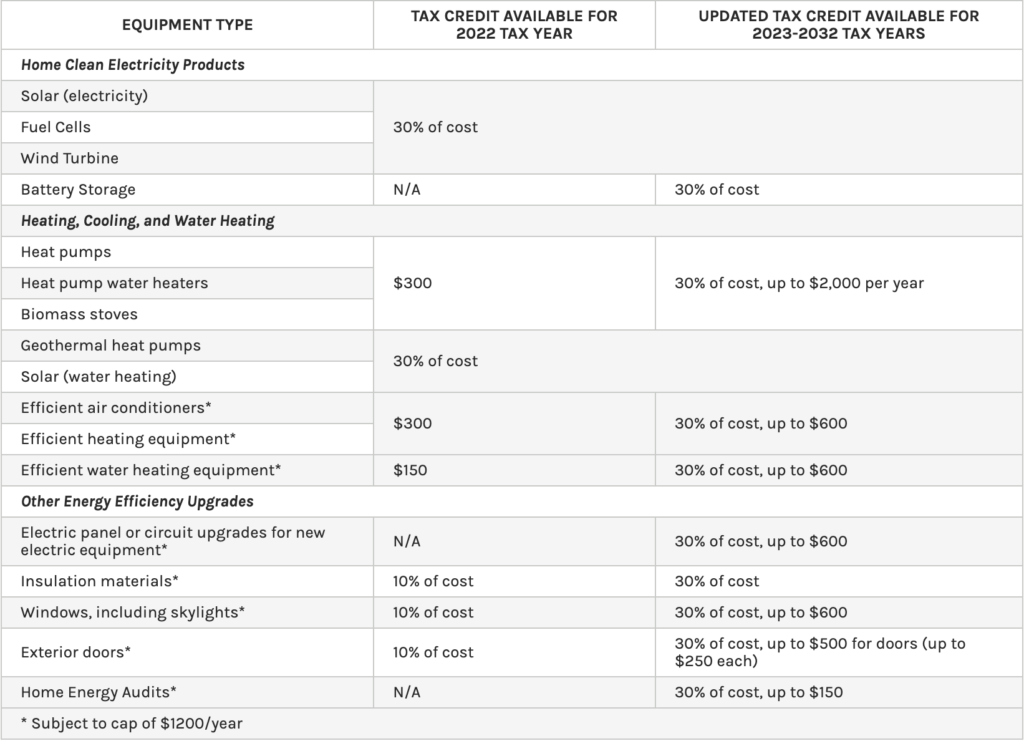

A: Consumers can claim the same or varying credits year after year with new products purchased, but some credits have an annual limit. See the table above.

Q: How do consumers find qualified professionals to conduct home energy audits?

A: Visit /energysave/professional-home-energy-assessments.

Fore more FAQ and Information, click the resource link below.

Related Resources

Careers in Green Buildings, Energy Efficiency & More

Explore the Green Buildings Career Map to learn about jobs and opportunities in the green buildings and energy efficiency industry.