Oct 18, 2021

Economic Development Opportunities for Pennsylvania’s Coal Plant Communities

Pennsylvania's coal communities are facing an uncertain future as energy markets shift towards more cost-effective and cleaner sources. The state's entry into the Regional Greenhouse Gas Initiative (RGGI) could provide critical funding to ease this transition and provide new opportunities for workers and small businesses.

By: Joe Cullen

Last month, Pennsylvania’s entrance into the Regional Greenhouse Gas Initiative (RGGI), a successful multistate program to cut carbon pollution from power plants and jumpstart clean energy job creation, received a big boost with an approval by the state Independent Regulatory Review Commission (IRRC). Since then, committees in the state House and Senate, in divided votes, voted to stop this important economic development initiative, raising various procedural and bureaucratic objections, but ignored the most critical question: how can coal communities respond to the changing energy marketplace while providing new opportunities for small businesses and workers that might otherwise be left behind?

The answer to that critical question is neither academic nor remote, as several coal plant communities are facing hard prospects right now.

One case in point is the Cheswick Generating Station in Allegheny County, which will shut down in April 2022 due in large part to an inability of coal plants to compete with other energy sources like natural gas.

That closure, which was announced by Cheswick’s owner along with plants in Maryland and Ohio, was the latest in a long series of energy market-driven coal plant retirements described in a recent report by the Ohio River Valley Institute (ORVI). The report shows how a national market trend away from coal to gas, wind, solar, and other less expensive electricity sources has affected Pennsylvania. Coal powered 57% of Pennsylvania’s electricity in 2001. By 2019, that coal-powered share dropped to 17%. It is projected to plummet further to a 4% share by 2030.

The market trend away from coal is unlikely to change. A recent study on Coal-Fired Power Plant Retirements in the U.S. determined that the current “all-in cost” of generating electricity from coal “is more than double” the cost of solar and wind, and “nearly double” the cost of natural gas. The Cheswick plant operated at only about 10% of its full capacity last year because there was so little demand for its high-cost, coal-generated electricity.

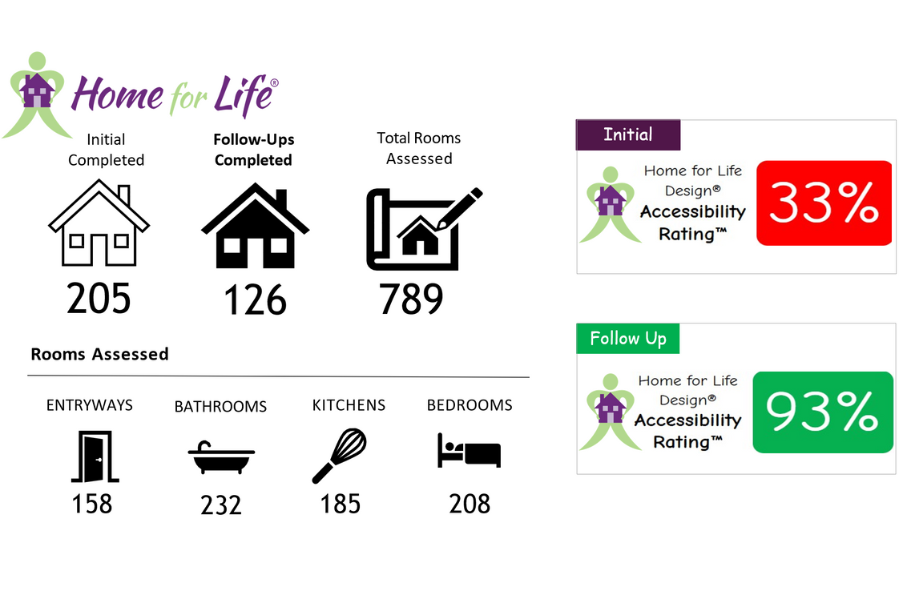

What can be done to address the consequences for coal plant workers and communities of this long-term market trend? To help answer that question, ORVI produced eight case studies, including six from states that have joined RGGI, to show what investments can be made to create jobs and boost communities impacted by energy market changes away from coal. The ORVI Report makes a compelling case for joining RGGI to support PA’s coal plant communities.

During a public input process on the RGGI proposal in which favorable comments outnumbered the opposition by a ratio of 7 to 1, many made a strong business case for why coal plant communities could benefit from RGGI. As one energy company noted, “with or without RGGI, Pennsylvania coal plants will be challenged and face an uncertain future. With RGGI, however, funds are available to ease this transition and provide opportunities for the future without having to impact the taxpayer.”

Consistent with these views, the Wolf Administration has proposed devoting RGGI funding to an Energy Communities Trust Fund “to provide direct support to dislocated workers and communities experiencing impacts from the closure of existing power plants.”

The ORVI Report provided some “show me the money” research on how RGGI funds have already been used in coal plant communities in other states, detailing six examples where RGGI funding has been directly invested in coal plant communities to create jobs and develop economic strategies to replace lost coal plant jobs.

These examples demonstrate that with hard work and consensus building at the local level, RGGI-funded activities can support local coal plant communities, including direct financing for site demolition, repurposing, or cleanup; replacing local tax revenues to support schools and municipalities; supplemental funding for state job training and placement for displaced workers; and assistance for local community planning, project development and support for public-private community investment strategies.

Now is also the time to take advantage of new market trends and federal efforts to stimulate jobs through emergency relief for the COVID crisis and infrastructure investments. In previous studies (Repairing the Damage from Orphan Wells and Abandoned Mine Lands), ORVI made a strong case for why Pennsylvania is uniquely positioned to benefit from federal infrastructure investments to restore abandoned mine lands and to cap orphan oil and gas wells, estimated to create over 30,000 well-paying, local jobs.

Combining RGGI funding with new federal infrastructure investments could provide powerful and new market dynamics to create critical jobs in the same Pennsylvania coal communities where a skilled workforce is facing unprecedented challenges.

RGGI opponents have so far offered no new economic development vision or pragmatic solutions to the problems faced by coal communities. RGGI opponents have completely ignored the role that RGGI funding could play in preparing to take advantage of the federal infrastructure investment opportunity.

That brings us back to the fundamental question: What’s the best path forward for Pennsylvania’s coal plant communities?

Rejecting RGGI and allowing market forces to shutter coal plants with little or no help to cushion job losses, provide site cleanup, and replace lost local tax funding; or adopting RGGI and using a significant portion of new RGGI proceeds, combined with federal infrastructure investments if they are enacted, to create jobs and ease the transition for coal plant workers and local communities across the Commonwealth. The choice could not be clearer.